www.afterprime.com is operated by Afterpime Limited, a Securities Dealer authorised by the Financial Services Authority (“FSA”) of Seychelles with license number SD057.

Please be aware that our services are not available to persons or entities based in undefined .

In case you are an EEA/EU resident, and you would like to open a trading account with Afterprime Europe, please visit www.afterprime.eu .

If the above message is shown in error or if you already have an account with Afterprime Limited, you may proceed accordingly by clicking here .

Thank you for visiting www.afterprime.com

Please be aware that our services are not available to persons or entities based in undefined .

If the above message is shown in error or if you are not a resident of undefined, you may proceed accordingly.

|

Instrument

|

Bid | Spread | Ask | |

|---|---|---|---|---|

|

0.903

|

0.30 |

0.903 |

Trade | |

|

0.560

|

0.20 |

0.560 |

Trade | |

|

95.6

|

0.00 |

95. |

Trade | |

|

1.094

|

0.40 |

1.095 |

Trade | |

|

0.621

|

0.20 |

0.621 |

Trade | |

|

105.9

|

0.01 |

105.9 |

Trade | |

|

170.5

|

0.00 |

170.5 |

Trade | |

|

1.653

|

0.20 |

1.653 |

Trade | |

|

1.493

|

0.70 |

1.493 |

Trade | |

|

0.927

|

0.10 |

0.927 |

Trade | |

|

0.828

|

0.10 |

0.828 |

Trade | |

|

158.2

|

0.00 |

158.2 |

Trade | |

|

1.810

|

1.40 |

1.810 |

Trade | |

|

1.995

|

0.70 |

1.995 |

Trade | |

|

1.802

|

0.70 |

1.802 |

Trade | |

|

1.119

|

0.50 |

1.119 |

Trade | |

|

190.9

|

0.01 |

190.9 |

Trade | |

|

2.185

|

1.70 |

2.185 |

Trade | |

|

0.824

|

0.30 |

0.82 |

Trade | |

|

0.511

|

3.70 |

0.512 |

Trade | |

|

87.3

|

0.01 |

87.3 |

Trade | |

|

0.582

|

0.10 |

0.582 |

Trade | |

|

1.709

|

1.10 |

1.709 |

Trade |

|

Instrument

|

Bid | Spread | Ask | |

|---|---|---|---|---|

|

0.856

|

0.50 |

0.856 |

Trade | |

|

21.322

|

30.50 |

21.325 |

Trade | |

|

11.784

|

29.80 |

11.787 |

Trade | |

|

11.551

|

30.40 |

11.554 |

Trade | |

|

1.416

|

1.00 |

1.416 |

Trade | |

|

19.019

|

80.00 |

19.027 |

Trade | |

|

14.220

|

50.40 |

14.225 |

Trade | |

|

13.926

|

329.70 |

13.959 |

Trade | |

|

0.782

|

0.80 |

0.782 |

Trade | |

|

111.6

|

0.01 |

111.7 |

Trade | |

|

7.285

|

1.80 |

7.285 |

Trade | |

|

7.780

|

2.80 |

7.780 |

Trade | |

|

20.213

|

33.50 |

20.21 |

Trade | |

|

11.171

|

31.90 |

11.174 |

Trade | |

|

10.950

|

30.40 |

10.95 |

Trade | |

|

1.342

|

0.70 |

1.342 |

Trade | |

|

34.0

|

0.01 |

34.0 |

Trade | |

|

18.031

|

69.00 |

18.037 |

Trade | |

| Trade | ||||

| Trade | ||||

| Trade | ||||

|

4.043

|

26.70 |

4.046 |

Trade | |

|

1.527

|

3.90 |

1.527 |

Trade | |

|

8.207

|

3.40 |

8.207 |

Trade | |

|

414.2

|

0.27 |

414.5 |

Trade | |

|

4.265

|

11.00 |

4.266 |

Trade | |

|

5.145

|

50.00 |

5.150 |

Trade | |

|

13.4

|

0.00 |

13.4 |

Trade | |

|

0.980

|

4.10 |

0.980 |

Trade | |

|

13.6

|

0.00 |

13.6 |

Trade | |

|

23.786

|

150.00 |

23.801 |

Trade | |

|

392.4

|

0.70 |

393.1 |

Trade |

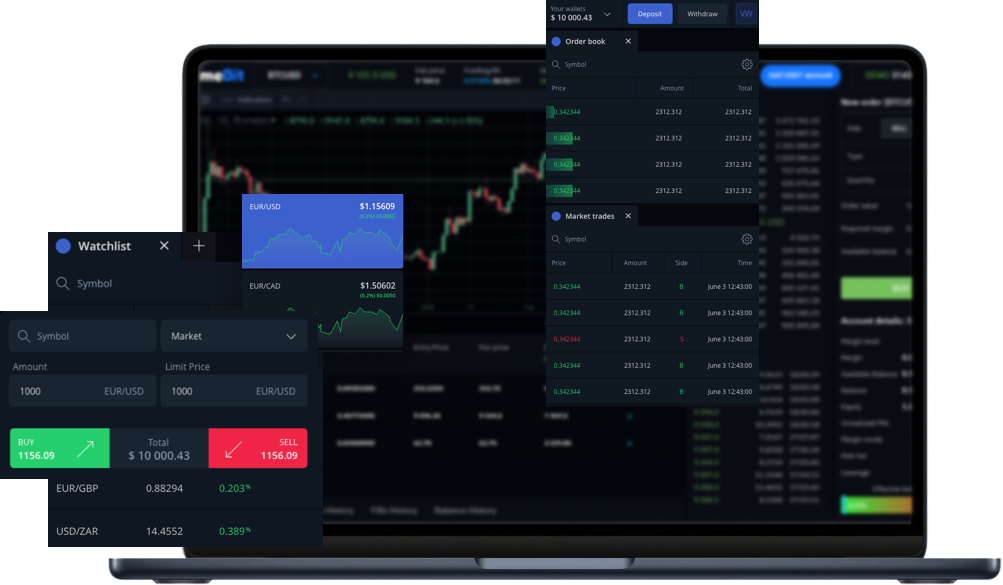

Trade the interbank Forex market alongside banks, HFTs, ECNs, and Dark pools for the best fills and lowest costs during all market conditions. Access popular currency markets: EURUSD, GBPUSD, AUDUSD, USDJPY +more

Spreads From

FX Markets

Execution

Trade

Funding

Foreign Exchange trading is our specialty. We operate with an institutional-style trading setup, backed by multiple prime brokers and over 26 liquidity providers.

This allows us to offer you highly competitive pricing and exceptional trade execution. Our focus is on supporting you and helping you succeed in the markets.

Our market leading Forex spreads are connected to you via low latency enterprise grade trading infrastructure in the famous Equinix NY4 (NJ) datacentre.

Liquidity providers

Average Execution Speed

Server uptime

Get the price you see and want with ultra fast order execution speeds.

Currency trading with competitive spreads. Access popular currency markets: EURUSD, GBPUSD, AUDUSD, USDJPY +more.

There are no fees or charges to access our platforms. Get to know them with zero commitments.

View Commodities Trading conditions across our range of Forex markets to see how trading with Afterprime is your best move.

"At Afterprime, we live and breathe forex, and we're passionate about helping our clients navigate the markets with ease and confidence."

Jeremy Kinstlinger, Founder"With lightning-fast trade execution, tight spreads, and low fees, our forex trading services offer unbeatable value and performance for our clients."

Elan Bension, FounderForex or the Foreign Exchange Market is recognised as the largest and most liquid financial market in the world. Trading forex involves exchanging one currency for another, the price of which is determined by supply and demand. Forex products are traded as pairs in which currencies are valued against one another. For instance, AUD/USD is the Australian dollar valued against the US dollar. If you were to buy 1 lot of AUD/USD you would be buying 100,000 Australian dollars by delivering the equivalent (roughly 71,000 in US dollars @ X-Rate AUD/USD 0.71.)

The competitive leverage rates which we give you are determined by the Afterprime entity you register with.

The global Forex or foerign exchange market trades almost 24 hours a day 5 days a week from Monday to Friday. The hours are 5pm ET/EDT (New York) on Sunday afternoon/evening to 4:59 pm ET/EDT (New York) on Friday afternoon/evening.

GMT +3 (DST) / GMT + 2 (non DST)

Our Forex commissions start at USD $7 USD per 1 lot round turn.

You can trade Forex using our MetaTrader 4, Trader Evolution, TradingView and FIX API trading platforms.

The average execution speed for Forex is < 25ms.

Afterprime has some of the tightest Forex spreads in the world.

The maximum Forex lot size per trade that can be executed is 1000 lots.

Test our platforms for free and jump into our Discord to see the magic unfold.

We look forward

to supporting you on your trading journey.

Trading CFDs and FX is high risk and not suitable for all investors. Losses can exceed your initial investment. Any Information or advice contained on this website is general in nature and has been prepared without taking into account your objectives, financial situation, or needs. Our Risk Disclosures and Legal documents should be considered before deciding to enter into any derivative transactions.

The information on this site is not directed at residents of the following countries: Australia, United States, China, New Zealand, Japan, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Afterprime Ltd (Seychelles company registration number 8426189-1) is a Securities Dealer, authorised by the Financial Services Authority (FSA) with licence number SD057. The registered office of Afterprime Ltd is 9A CT House, 2nd floor, Providence, Mahé, Seychelles.

Afterprime Ltd (BVI Company registration number 1519429) is authorised to provide financial technology and brokerage support services. The registered office of Afterprime Ltd is Portcullis Chambers, 4th Floor, Ellen Skelton Building, 3076 Sir Francis Drake Highway, Road Town, Tortola, British Virgin Islands VG1110.

Payment processing performed by SC Afterprime Limited a Cyprus incorporated company with registration number HE 615319 and registered office at Archiepiskopou Makariou ΙΙΙ, 160, 1st Floor, 3026, Limassol, Cyprus.

The entities above are duly authorised to operate under the Afterprime brand and trademarks.

© Copyright 2024 Afterprime. All rights reserved. All trademarks, service marks, trade names, trade dress, product names and logos appearing on the site are the property of their respective owners | Sitemap